Fund manager Neil Woodford has dumped around £1.4billion worth of shares in the past six months to raise money as unhappy investors pull money from his underperforming funds.

Woodford has reduced his holdings in some companies including brickmaker Forterra and travel website Hostelworld.

A combination of investor redemptions and underperformance stemming from bad bets on some blue-chip firms, such as Provident Financial and the AA, has seen the assets under management across his three funds shrink from £17 billion to £11 billion.

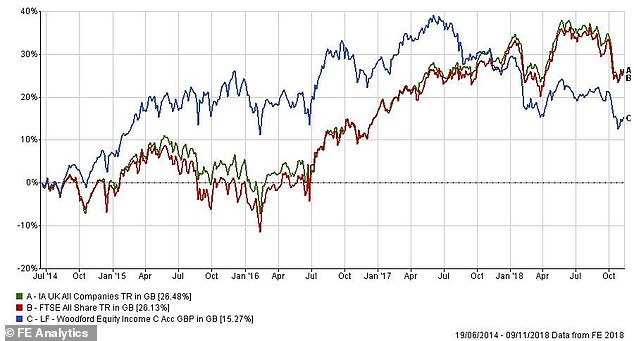

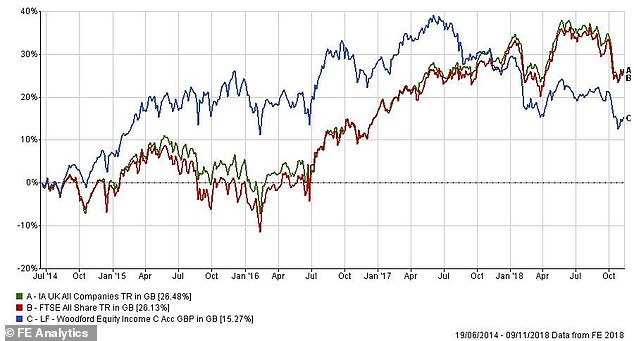

Woodford’s flagship Equity Income fund has underperformed against the benchmark FTSE All Share index and the average fund in the Investment Association’s All Companies sector over four years

His Income Focus fund is down 8 per cent since March 2017, while the Patient Capital investment trust is down by almost 15 per cent since April 2015.

The Equity Income fund has fared better (up 15 per cent) but its performance is over a longer period (since June 2014) and still lags behind the FTSE All-Share Index (up 26 per cent).

It also trails behind the 26 per cent return generated by the average fund with a similar mandate in the Investment Association’s All Companies sector.

Woodford admitted in last week’s Mail on Sunday the past two years have been his ‘most difficult period’.

Although the fund manager insists he does not want to portray himself as a victim, it is obvious he is feeling unloved: targeted by a hostile press, abandoned by many investors (and some financial advisers) writes Jeff Prestridge.

He adds Woodford also feels victimised by hedge fund managers who have shorted some of his funds’ holdings – betting on them falling in price.

Click here to read the interview in full.Â