Banks and building societies should be rushing to beat each other’s cash Isa rates – instead the only race appears to be to the bottom.

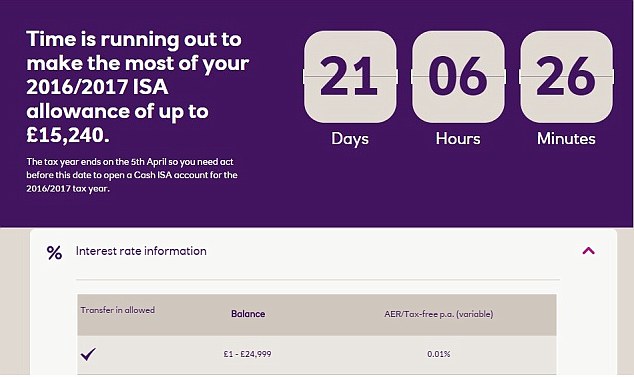

Welcome to Isa season 2017, where NatWest genuinely has a countdown clock warning there’s only 21 days, six hours and 26 minutes to get a cash Isa with a 0.01% interest rate.

In this environment, it’s no surprise that the Minor Investor’s purely anecdotal sentiment index has found more people are considering investing to beat appalling savings rates.

Holding out for a hero: The Dividend Hero list features those investment trusts that have the longest track records of increasing payouts each year

The trade-off for the prospective returns on these trusts being higher than on cash, is that one day you may open your investing account and discover less than you put in.

If this is a problem, then don’t invest. Money that you might need in its entirety in the short-term, perhaps if the boiler packs up, or for a house deposit, shouldn’t be invested.

If you can live without the cash for a good while though, then you might want to consider one of these trusts.

The five I’ve dug out all have a decent dividend that’s likely to keep rising – so as not to spoil those long-term records – and four of them can be bought for less than the sum of their parts.

I’m considering sticking a few in my own Isa, but if you think about investing make sure you do your own research because they may or may not be right for you.Â

| Company | Consecutive years dividend increased |

Premium / Discount |

Ongoing charges | Ten-year total return | Yield |

|---|---|---|---|---|---|

| City of London | 50 | 1.1% | 0.43% | 122.2% | 3.9% |

| Murray Income | 43 | -8.4% | 0.77% | 74.5% | 4.2% |

| Merchants Trust | 34 | -4.5% | 0.58% | 72.5% | 5.1% |

| Temple Bar | 33 | -3.8% | 0.49% | 128.2% | 3.2% |

| Schroder Income Growth | 21 | -8.3% | 1.01% | 111.7% | 3.8% |

Five dividend hero picksÂ

These are five investment trusts from the full dividend heroes list that looked interesting and worth further investigation for those looking for Steady Eddie income investments.

The criteria for choosing them was a blend of a dividend yield that broadly matched or beat the FTSE All-Share’s 3.4 per cent yield and decent long-term performance over ten years. Four offer the ability to buy on a discount – although this should never be reason alone to invest – while the other trust City of London has a record that justifies its slight premium.

If you are considering investing, look for more information on the trusts on the AIC website and read their factsheets and annual reports that can be found there. Also consider how any investments fit into your overall portfolio and investing plan.

This quick look at the trusts is from my point of view as a private investor and journalist, if you need help investing seek professional financial advice.

City of LondonÂ

City of London is the king of the dividend heroes. It is one of the trio of investment trusts with the longest history of raising payouts, boasting a 50 year record. Unlike fellow half-centurions Bankers and Alliance Trust, however, it has a stock market-beating yield (the other two yield 2.2 per cent and 1.8 per cent and are global not income trusts). Five-year average dividend growth is 3.3 per cent annually and the reserves hold 70 per cent of a year’s dividend cover.

It has been managed by Job Curtis since 1991, with that 26-year stint a remarkable run in itself. Despite his strong stock-picking record, Curtis is a modest manager who has displayed real commitment to his investors over the years (and the board has cut charges for them too).Â

The trust trades at a slight premium of 1.1 per cent, but is in this list due to its 50-year dividend-raising history and ten-year total return of 122 per cent, which comfortably beats the FTSE All-Share’s 83 per cent total return over that period. Ongoing charges are just 0.43 per cent. Disclosure: This is one that’s already in my Isa.

Murray IncomeÂ

Firstly, Murray Income trust is not to be confused with Murray International, the global trust managed by contrarian Bruce Stout. It is still worth a look, however, as it offers the chance to pick up an investment trust yielding 4.2 per cent, with a 43-year long history of raising dividends at a discount of 8.8 per cent to the sum of its parts.

So why is the share price trading so far below the net asset value when people are hungry for income? Firstly, it’s worth noting that the trust hasn’t performed as well as the broad UK stock market. Murray Income has a total return of 74.5 per cent, compared to the FTSE All-Share’s 83 per cent over ten years. It sits about halfway down the performance list for UK equity income trusts over a decade. Dividend growth has been good but not stunning over the past five years at an average of 1.6 per cent.

However, the trust has 1.3 years worth of dividend cover, yields more than the sector average of 3.6 per cent and with a relatively focussed portfolio of 49 stocks and an active share of 62.4 per cent it is no closet tracker. Among the top 20 holdings are some interesting non-traditional UK income names, such as Nordea Bank, Microsoft and Close Brothers. Managers say they look for ‘diversified earnings streams, strong balance sheets and superior business models with attractive valuations’ to deal with uncertain times ahead.

Merchants TrustÂ

Merchants Trust is in here as its yield is a bumper 5.1 per cent and it can be bought at a 4.5 per cent discount.

So, once more, why the discount? Â Merchants has also failed to beat the FTSE All-Share over ten years, with a 72.5 per cent total return to the market’s 83 per cent. It has also raised the dividend by an average of just 0.8 per cent over the past five years. However, it has dividend cover of 0.93 years in the reserves.

Long-standing manager Simon Gergel has pointed to the trust out-performing the stock market over the past five years and its unashamed income focus. He told Mail on Sunday’s Jeff Prestridge: ‘We are income seekers and we make no apology for buying shares that provide the high yield we require. It’s why so many private investors hold the trust.’

The trust has 46 holdings and ongoing charges of 0.58 per cent, but investors should be aware that it does used borrowed money to try to boost returns, with a relatively high gearing figure of 18 per cent. You need to decide if that big yield is enough.

Temple BarÂ

Temple Bar has the best ten-year record of the five trusts highlighted here, with a 125 per cent total return to the FTSE All-Share’s 83 per cent.

It is managed by noted contrarian Alastair Mundy, a value investor who looks for cheap, out-of-favour companies, with decent balance sheets. On its website, the trust sums up its contrarian approach: ‘We aim to be sceptical of the crowd and aware of investor psychology, which often leads to an overvaluation of those stocks that are deemed to have good prospects and an undervaluation of those which are out-of-favour.’

Temple Bar had been trading at a hefty discount of as much as 10 per cent last year, but this has narrowed to 3.4 per cent now. Five-year dividend growth is at a healthy 2 per cent annual average, the trust has gearing of just 3 per cent and ongoing charges for this level of active management are cheap at 0.49 per cent. This is one I wish I’d tucked away when the discount was deeper.

Schroder Income Growth

Schroder Income Growth has delivered the third best ten-year total return here at 112 per cent, compared to the FTSE All-Share’s 83 per cent. It yields 3.8 per cent, has 0.97 years of dividend cover, and has average five-year dividend growth of 2.8 per cent. Yet, it is on an 8.2 per cent discount.

Those figures make it interesting. Fund manager Sue Noffke holds 44 stocks and the top ten includes a lot of the FTSE 100 usual suspects and the trust’s biggest exposure is 33 per cent to financial stocks, with HSBC making up 6 per cent, Lloyds 5 per cent and Aviva 4 per cent.

The trust says it has a ‘strategy of blending higher-yielding shares, providing steady income, with lower-yielding shares that offer the potential for faster-growing dividends.’

Further down the scale holdings include housebuilders Bellway and Taylor Wimpey, retailer Halfords and software firm Micro Focus International.

Ongoing charges are hefty at 1.01 per cent compared to the other trusts here, consider whether it’s worth paying those fees for the trust.