Investing in UK income funds is a hugely popular among  British investors, whether they are looking to draw on the dividends or compound them up to grow their wealth.

Picking the best income fund can be a tough choice though, especially as many rely on a few big FTSE 100 dividend-payers. In a bid to help investors separate the wheat from chaff, investment firm Sanlam UK publishes a half-yearly report revealing the best and worst UK-centric income funds.

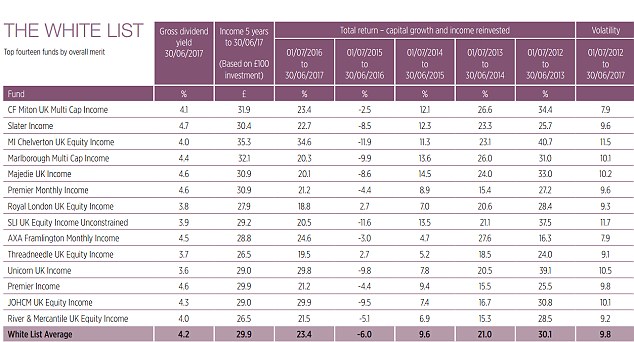

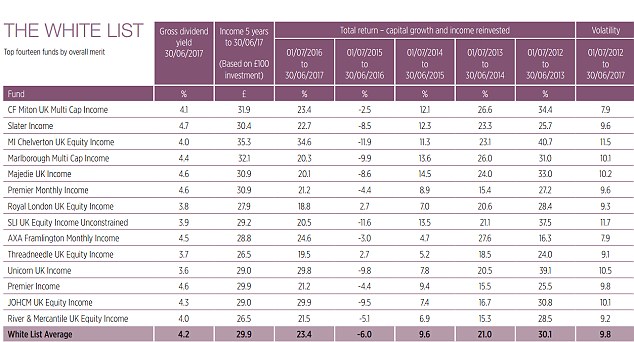

The study, which has been running for over three decades, reviews and tracks the performance of all funds in the the Investment Association UK Equity Income sector over a six-month period to the end of June and splits them into three categories: the White List, the Grey List and the Black List.

Funds on the top band White List have demonstrated they can deliver strong total returns over the last five years

1. CF Miton UK Multi Cap Income

Ongoing charges: 0.81 per cent

Yield: 4.1 per cent

Volatility: 7.9 per cent

The CF Miton UK Multi Cap Income  has maintained the number one spot six months on from the previous iteration of the income study Рdespite a slight fall in yield by 0.4 percentage point to 4.1 per cent. It invests mainly in UK shares although the fund has little exposure to other assets including European shares and UK bonds.

Sanlam said: ‘Combining consistently strong returns, low volatility and delivering a high income pay-out for the period reviewed, the fund is substantially ahead of its peers in terms of meeting the requirements set out in the study for income investors.’

A £100 investment over five years would have yielded an income of £31.90.

HOW THE RANKINGS WORK

To determine the best and worst performing funds, the study looked at the capital growth of each fund, absolute income – or income after the fund’s costs are taken into account – and volatility on a five-year basis.¬†

It calculates volatility by looking at how much a fund’s return each month for five years differs from its overall average return.

This is known as five-year standard deviation and the figure is provided to Sanlam by investment research firm Morningstar. The figure is not annualised and is based upon monthly total return figures over five years.

2. Slater Income

Ongoing charges: 0.81 per cent

Yield: 4.7 per cent

Volatility: 9.6 per cent

Mark Slater and Barrie Newton hold the reins to the Slater Income which targets an increasing level of income as well as long-term capital growth. Among its top holdings are staple dividend stock Phoenix Group and tobacco company Imperial Brands.

On a £100 investment, the fund would have given you £30.40 over five years.

3. MI Chelverton UK Equity Income

Ongoing charges: 0.89 per cent

Yield: 4 per cent

Volatility: 11.5 per cent

The MI Chelverton UK Equity Income fund has risen from the lowest position on the White List in the last study to rank third. It also boasts the highest income return of the funds on the list. The fund seeks to unearth stocks in the UK AIM sector with the potential to pay out a growing level of income.

Smaller firms run a greater risk of going bust than large ones so there is a heightened risk here.

An investment of £100 over five years would have generated £35.30 in income.

4. Marlborough Multi Cap Income

Ongoing charges: 0.80 per cent

Yield: 4.4 per cent

Volatility: 10.1 per cent

The Marlborough Multi Cap Income fund has climbed four positions since the last study. It invests in higher risk small and medium-sized companies – predominately where both capital and dividend growth are anticipated.

The fund is a fairly diversified portfolio with over 100 holdings including specialist asset manager Intermediate Capital Group, WHSmiths and SSE which are among the top ten.

It would have produced income of £32.10 on a £100 investment over five years.

5. Majedie UK Income

Ongoing charges: 0.77 per cent

Yield: 4.6 per cent

Volatility: 10.2 per cent

The Majedie UK Income fund has also climbed up the rankings since its last outing. It now holds fifth position on the White List – up from tenth six month earlier. It seeks to root out undervalued companies with a focus on those which are able to provide a growing level of income. The fund’s top three holdings are comprised of the usual suspects for income: ¬†Legal & General, HSBC and BP.

A £100 investment over five years would have generated an income of £30.90.

6. Premier Monthly Income

Ongoing charges: 0.92 per cent

Yield: 4.6 per cent

Volatility: 9.6 per cent

The Premier Monthly Income has been promoted from the Grey List to the top band. It aims to give investors rising level of dividends paid monthly. The bulk of the fund is comprised of FTSE 100 conglomerates which are renowned for delivering increasing levels of income. These include HSBC, Royal Dutch Shell and BP.

You would have received  £30.90 income on a £100 investment over five years.