Buying a single investment fund that’s simple and broad enough to do everything for you is a tempting idea.

It’s especially appealing to novices, who want something straightforward as a first step while they get the hang of investing.

Pension freedoms have also seen many older people taking active control of their retirement investments for the first time.

Those who until now just kept their money in workplace pension default funds understandably like the notion of drawing an income from a single fund that’s as easy to run and monitor as possible.

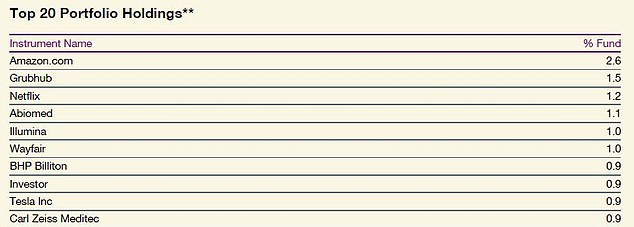

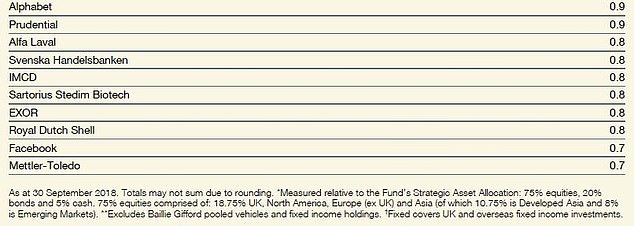

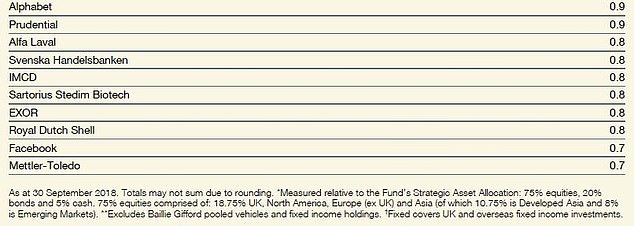

What does the fund hold: Amazon, Netflix, Tesla, Alphabet and Facebook are in the portfolio (Source: Baillie Gifford)

Adrian Lowcock of Willis Owen suggests taking a look at the funds below. He puts them under ‘cautious’ and ‘moderate’ headers, but notes that the Investment Association has scrapped these terms, and ‘adventurous’ as well.

He says it has replaced them with the following sectors, ‘basically because what is adventurous to one person might be moderate risk to another individual so the terms have no actual meaning on their own’.

Cautious – IA Mixed Assets 0-35% Shares

Moderate – IA Mixed Assets 20-60% Shares

Adventurous – IA Mixed Assets 40-85% Shares

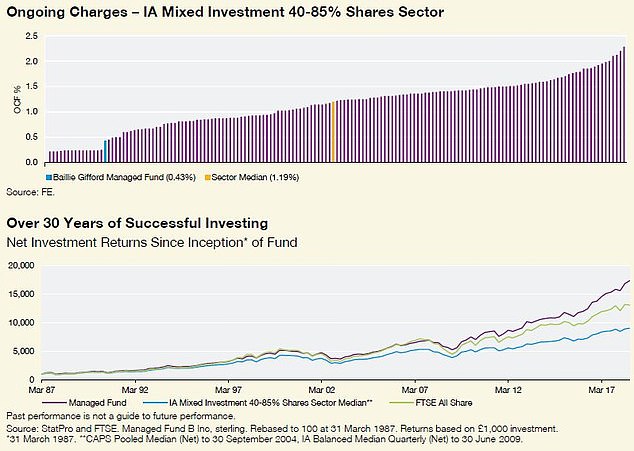

What is an ongoing charge?Â

The ongoing charge is the investing industry’s standard measure of fund running costs.

The bigger it is, the costlier the fund is to run.

The ongoing charge figure can be found in the Key Investor Information Document (KIID) for any fund, usually at the top of page two.

To track down these documents, put the fund name and ‘KIID’ together in an internet search engine. Read more here about investment charges.

Cautious

Jupiter Merlin Conservative Portfolio (active): ‘This fund aims for long-term capital growth with income and has a minimum exposure of 45% to bonds and cash,’ says Lowcock.

‘The team run a relatively concentrated portfolio and adopt an incremental approach to asset allocation which limits manager turnover.

‘The team’s investment process starts with a thorough assessment of the macro environment, which guides portfolio allocation and influences manager selection.

‘As with manager selection, the team’s approach to asset allocation is relatively high-conviction and long-term. Jupiter does not double charge on in-house funds, and they are used extensively within this strategy to limit overall costs.’Â

Ongoing charge: 0.97 per cent

Yield: 2.8 per cent

Vanguard LifeStrategy 20% Equity (passive): ‘This is a strong offering for investors seeking a straightforward, low-cost cautious-allocation fund.

‘The 20 per cent exposure to shares is split is 25 per cent UK versus 75 per cent overseas, and within bond part of the portfolio the split is 30 per cent UK and 70 per cent overseas. The fund is limited to equities and bonds because it uses index tracker funds.

‘Within the fixed-income portion there is a bias towards government bonds, and no sub-investment-grade exposure is held. This is because government bonds have generally provided more effective diversification from shares.’

Ongoing charge: 0.22 per cent

Yield: 1.4 per cent

Moderate

BMO MM Navigator Cautious (active): ‘The multimanager team responsible for the fund is one of the most experienced and stable within the UK.

‘It is led by Gary Potter and Robert Burdett, who have worked together since the early 1990s. Their main focus is on manager selection and providing competitive performance versus their sector peers.

‘They aim to add value from asset-allocation decisions but tend not to take large bets. Their detailed knowledge of fund managers means they are able to include new managers who are showing potential as well as long-established industry names.’

Ongoing charge: 1.61 per cent

Yield: 2 per cent

SLI MyFolio Market II (passive): ‘MyFolio’s investment approach has three key inputs – strategic allocation, tactical allocation, and fund selection – and makes broad use of SLI’s resources.

‘Strategic asset allocation is concerned with setting model portfolio allocations for the portfolio. Tactical positioning around the model portfolio allocations of each risk level is managed by SLI’s well-resourced multi-asset investing team.

‘Fund selection input is relatively limited and focused on identifying low-cost and low tracking error index funds.

‘MyFolio Market II has been running for about eight years and has been managed consistently with its objective over this period, while delivering strong performance that is helped by its low ongoing charge of 0.35 per cent.’Â

Ongoing charge: 0.35 per cent

Yield: 1.3 per cent

Retirees looking for income

JPM Multi-Asset Income (active): ‘Manager Michael Schoenhaut relies on 13 underlying managers to select investment opportunities within each sector.

‘The fund aims to deliver a high income but with lower risk than its benchmark. This fund is run with relatively high weightings in high-yield bonds and international shares compared to some peers. The dividend yield is typically in the range of 4 per cent to 6 per cent.’Â

Ongoing charge: 0.80 per cent

Yield: 3.8 per cent